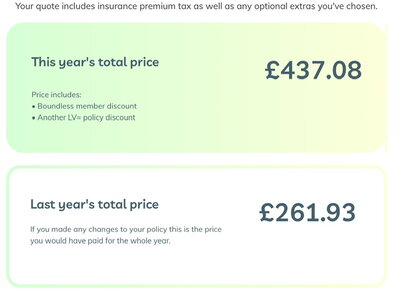

Our car insurance is due for renewal in a months time. I’m expecting the renewal quotation from LV soon. Currently we ha ve car and home insurance with LV via Boundless so get a discount, The cars are on one policy which has my grandson also as a named driver for one of the cars. Last year I used comparison websites, and also those companies that don’t use such sites. In the end LVs quotation was pretty well the cheapest of mainstream insurers.

This year I thought about using a broker too as well as comparison sites and direct quotes. Anyone had experience of using brokers for their cars. It’s not important to me having both cars on one policy, as price and reputation are the key drivers.

This year I thought about using a broker too as well as comparison sites and direct quotes. Anyone had experience of using brokers for their cars. It’s not important to me having both cars on one policy, as price and reputation are the key drivers.