- Nov 11, 2009

- 24,823

- 8,933

- 50,935

Last year I posted thread on the same topic and wondered if anyone had used brokers. Wonder no more as today I used Swinton and the combined quote for a Kia rio and RAV4 was around £1550 compared to LVs most recent which was £575 for RAV 4 and £372 for Rio. Both cars had me and my wife as Social, and the RAV had daughter on Business with Rio having Grandson on Business. But on seeking quotes three companies curtailed the quote process as my Grandson is in the Army Reserve as well as working full time. I looked at Multi Vehicle policies as is my LV one and they came out around £1450-1670 without daughter or grandson. I was going to opt for Taco with the RAV until it shot up by £70 due to a very minor no fault incident two years ago when a lady reversed her CRV in to the Rio and I was just walking up the road.

I thought Id got a decent deal with Hastings Premium for the RAV until certain unacceptable endorsements popped up. So after much angst I decided to take the daughter and grandson off our policies. Insured the Rio with the Saga for £228 cf LVs £373. The RAV 4 is now with a AXA Plus at £623 as once id removed the Rio from the LV multi policy the RAV went from £575 to £721. So after being with Frizzell then Liverpool Victoria then LV as the company morphed went have policies with LV as the house went to Halifax last June.

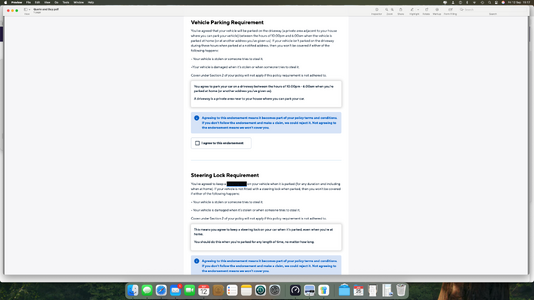

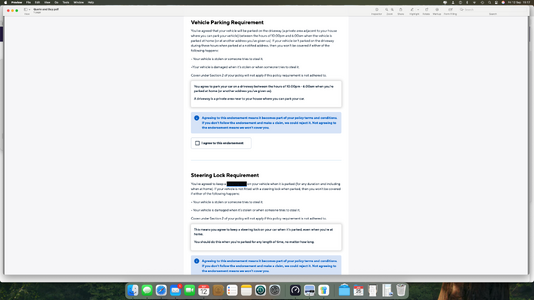

The quite unacceptable endorsements from Hastings Premium are shown below. And it wasn't that they were any cheaper than AXA, or Tesco for the RAV.

So I saved around £90 for the two cars and obtained some improvements in cover.

I thought Id got a decent deal with Hastings Premium for the RAV until certain unacceptable endorsements popped up. So after much angst I decided to take the daughter and grandson off our policies. Insured the Rio with the Saga for £228 cf LVs £373. The RAV 4 is now with a AXA Plus at £623 as once id removed the Rio from the LV multi policy the RAV went from £575 to £721. So after being with Frizzell then Liverpool Victoria then LV as the company morphed went have policies with LV as the house went to Halifax last June.

The quite unacceptable endorsements from Hastings Premium are shown below. And it wasn't that they were any cheaper than AXA, or Tesco for the RAV.

So I saved around £90 for the two cars and obtained some improvements in cover.