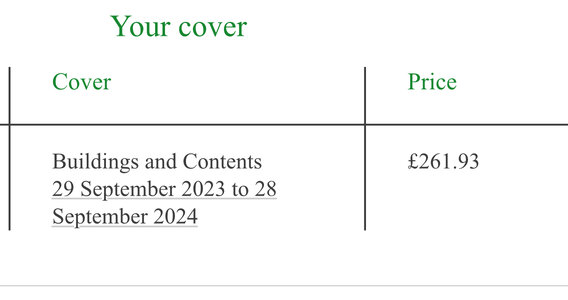

After ten years with the same Insurer last year , their increase was unbelievable , £110.00. A move to a new blue chip,, Raywood blue chip,Defaqto, last year was actually cheaper than the existing before renewal.

They got me this year! A £60 increase🤮.

So wasted the morning , initially compare sites etc. Confusing! Trying to mirror image the cover I wanted with these sites was amazingly confusing and frankly dangerous to the not so well informed.

Next stop was checking with each insurer direct following the blue chip list from Which?

The two top boys NFU and LV who have been well praised on here were quoting In excess of £1k🙀

Back to the drawing board and amazingly my current guys with the broadest cover you could want out on tops on cover and cost . I bit their hand off for 5he renewal😎

Costs are ever rising and I warn all of you be ver6 careful,of these compare sites. They chop out loads of important covers to make the premium cheap. People fall for it but of course all the riders are on site so not their fault when you you don’t get what you think you get!

They got me this year! A £60 increase🤮.

So wasted the morning , initially compare sites etc. Confusing! Trying to mirror image the cover I wanted with these sites was amazingly confusing and frankly dangerous to the not so well informed.

Next stop was checking with each insurer direct following the blue chip list from Which?

The two top boys NFU and LV who have been well praised on here were quoting In excess of £1k🙀

Back to the drawing board and amazingly my current guys with the broadest cover you could want out on tops on cover and cost . I bit their hand off for 5he renewal😎

Costs are ever rising and I warn all of you be ver6 careful,of these compare sites. They chop out loads of important covers to make the premium cheap. People fall for it but of course all the riders are on site so not their fault when you you don’t get what you think you get!