My van Insurance is due in a couple of weeks. My current Insurer is Caravan Guard (who I have used for more than one year). They sent me the usual reminders including a renewal premium a few £ less than last year. Of course, as expected, they did ask me to check current van price and since that has increased I expected the premium to increase too. The new premium has increased - by less than £10.

Obviously we all have differing considerations with regards to cover so my experience may not "fit everyone" . (Basically new for old, Eccles 480 2019, contents and awning covered, £100 excess, with no claims, legal cover, European cover and no protected bonus).

I have been insured with Towergate in the past so filled out an on-line form but was told I would need to speak with them before moving forward. Turns out they wanted to confirm I had no medical conditions that affected my driving licence. I was given a price over TWICE that I have paid with Caravan Guard.

But here's the bit that really surprised me.

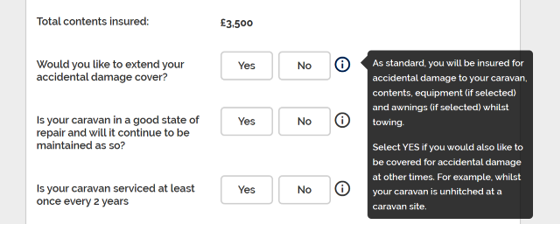

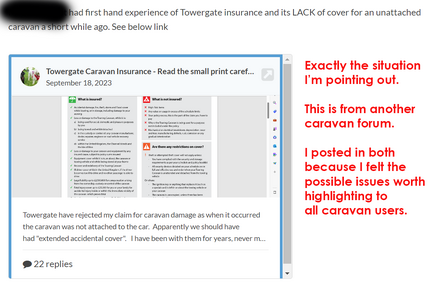

Towergate ask on the application form if you want extended cover. That translates to the policy covers the van whilst being towed but NOT SITED OR IN STORAGE. If you want that you tick the box and pay extra for it.

I have just telephoned Caravan Guard concerned that I may have missed similar constraints but I am informed, as expected, provided the agreed security devices are in place the van is covered with no extra premium or declaration required.

Please be sure you are covered wherever it is needed. To have damage on-site that's not covered could be disastrous.

Obviously we all have differing considerations with regards to cover so my experience may not "fit everyone" . (Basically new for old, Eccles 480 2019, contents and awning covered, £100 excess, with no claims, legal cover, European cover and no protected bonus).

I have been insured with Towergate in the past so filled out an on-line form but was told I would need to speak with them before moving forward. Turns out they wanted to confirm I had no medical conditions that affected my driving licence. I was given a price over TWICE that I have paid with Caravan Guard.

But here's the bit that really surprised me.

Towergate ask on the application form if you want extended cover. That translates to the policy covers the van whilst being towed but NOT SITED OR IN STORAGE. If you want that you tick the box and pay extra for it.

I have just telephoned Caravan Guard concerned that I may have missed similar constraints but I am informed, as expected, provided the agreed security devices are in place the van is covered with no extra premium or declaration required.

Please be sure you are covered wherever it is needed. To have damage on-site that's not covered could be disastrous.