-

We’re currently investigating an issue related to the forum theme and styling that is impacting page layout and visual formatting. The problem has been identified, and we are actively working on a resolution. There is no impact to user data or functionality, this is strictly a front-end display issue. We’ll post an update once the fix has been deployed. Thanks for your patience while we get this sorted.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

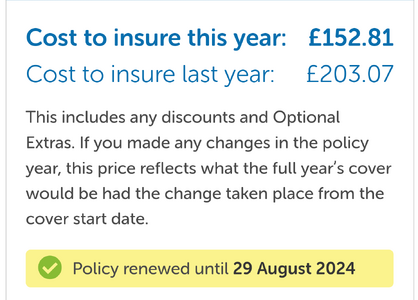

Car Insurance continue to spiral😥😥

Page 2 - Passionate about caravans & motorhome? Join our community to share that passion with a global audience!

I have already had the shock with a £200 rise and no appreciable saving possible after doing comparisons.I think we are all in for a big shock at renewal Clive. When two blue chip Insurers pull out. I’m concerned. Can you imagine an HMG scheme 🤮🤮🤮

No mates rates Ray😉I have already had the shock with a £200 rise and no appreciable saving possible after doing comparisons.

You can all read why the Motor Insurance Market this year is heading for a car crash!

We all know about car cannibals! Repairing a modern car , even a minor ding, is a few hundred pounds. EVs I understand cost a lot more to repair, primarily due to HSE requirements to protect the operative from electrocution and the limited supply of spare parts.

When the likes of Zurich and RSA pull out of private motor Insurance who will be next? Will we be paying even more than ever?

We all know about car cannibals! Repairing a modern car , even a minor ding, is a few hundred pounds. EVs I understand cost a lot more to repair, primarily due to HSE requirements to protect the operative from electrocution and the limited supply of spare parts.

When the likes of Zurich and RSA pull out of private motor Insurance who will be next? Will we be paying even more than ever?

My renewal from Churchill came through yesterday. New price up by 52% on last year. I contacted them but they would not budge. I am renewing like for like with another provider for an increase of about 20%, so no avoiding an increase.

However, I have a couple of motorcycles and recently renewed my insurance on them. The price went down slightly. bizarre, but I did not argue with them!

However, I have a couple of motorcycles and recently renewed my insurance on them. The price went down slightly. bizarre, but I did not argue with them!

I worked for PSA who have given up on car insurance as results so bad, but they got too expensive some time back and have been with Aviva since.No mates rates Ray😉

That’s a good price, strange old world isn’t it? What company is it insured with.My old Shogun (2004 3.2 diesel) passed it's MOT again on Tuesday with no advisories and I've just renewed it's insurance, comprehensive - pleasantly surprised - no changes in excess etc vs last year but down by £50.

Hi Clive, strange indeed (but for once, for me- in a good way) it's insured with esure.That’s a good price, strange old world isn’t it? What company is it insured with.

Something you might consider is to check your annual mileage, many companies will reduce the cost if a lower mileage is set.

However you need to monitor your mileage, becasue if it looks as though you're going to exceed the agreed lower limit, you must advise your insurer as to continue having exceeded the limit you would be driving without insurance.

However you need to monitor your mileage, becasue if it looks as though you're going to exceed the agreed lower limit, you must advise your insurer as to continue having exceeded the limit you would be driving without insurance.

That contradicts what I was told when renewing my insurance and negotiating for a lower price.Normally the lower the mileage the higher the premium. Insurance companies view it that the person is not a regular driver and is more of a risk than someone with high mileage who drives regularly.

Maybe it varies with insurers.

I’ve never found that for either of our cars. If we put 10000 mikes limit it’s more expensive than 7000 miles.Normally the lower the mileage the higher the premium. Insurance companies view it that the person is not a regular driver and is more of a risk than someone with high mileage who drives regularly.

A new one of me.......

Yesterday while talking to a neighbour, he told me that his wife had just crashed her car because a dog ran out in front of her. They claimed on the insurance but despite having a protected no claims discount they will lose it. As there was no other uninsured driver involved . I can't validate any accuracty of this statement as I don't know who they're insured with.

Anyway it made me check my own insurance for which I have a protected NCD add-on. There are two interesting statements:-

If you have comprehensive cover and you make a claim where the driver of the other car involved in the accident is found to be uninsured, you will not have to pay your excess or lose any part of your no claims discount (NCD) as long as:

● You are able to provide the make model and registration number of the other car involved;

● We can establish that you were not at fault in any way.

It will also help if you are able to provide the details of the other driver involved and details of any independent witnesses if possible.

When you first claim, you may have to pay your excess and your NCD may be affected but once we have established that you were not at fault in any way and the driver of the other car was uninsured your excess will be refunded and NCD restored

The following will not reduce your NCD:

1. any payment made under Section D (Windscreen and window damage).

2. any payment made under Section L (Breakdown option).

3. any payment for emergency treatment fees under Section C (Your legal liability to other

people).

4. claims where you are not at fault, provided we have got back all that we have paid from

those who are responsible

This last statement is interesting because it seems to me that if you're involved in an accident where the other party doesn't stop then you'll lose the NCD. Or what happens if you slide of the road and hit a tree - who owns the tree?

Many years back on the M25 a foreign lorry wandered over to my lane while I was overtaking, and scrapped all down the side of my car. It kept going and all though I reported it to the police there was no chance of finding out who was responsible. My insurance company paid but I didn't lose my NCD

Yesterday while talking to a neighbour, he told me that his wife had just crashed her car because a dog ran out in front of her. They claimed on the insurance but despite having a protected no claims discount they will lose it. As there was no other uninsured driver involved . I can't validate any accuracty of this statement as I don't know who they're insured with.

Anyway it made me check my own insurance for which I have a protected NCD add-on. There are two interesting statements:-

If you have comprehensive cover and you make a claim where the driver of the other car involved in the accident is found to be uninsured, you will not have to pay your excess or lose any part of your no claims discount (NCD) as long as:

● You are able to provide the make model and registration number of the other car involved;

● We can establish that you were not at fault in any way.

It will also help if you are able to provide the details of the other driver involved and details of any independent witnesses if possible.

When you first claim, you may have to pay your excess and your NCD may be affected but once we have established that you were not at fault in any way and the driver of the other car was uninsured your excess will be refunded and NCD restored

The following will not reduce your NCD:

1. any payment made under Section D (Windscreen and window damage).

2. any payment made under Section L (Breakdown option).

3. any payment for emergency treatment fees under Section C (Your legal liability to other

people).

4. claims where you are not at fault, provided we have got back all that we have paid from

those who are responsible

This last statement is interesting because it seems to me that if you're involved in an accident where the other party doesn't stop then you'll lose the NCD. Or what happens if you slide of the road and hit a tree - who owns the tree?

Many years back on the M25 a foreign lorry wandered over to my lane while I was overtaking, and scrapped all down the side of my car. It kept going and all though I reported it to the police there was no chance of finding out who was responsible. My insurance company paid but I didn't lose my NCD

If you slide off a road and hit a tree, it's not the tree's fault - it's your fault so it'll be recorded as a fault claim.A new one of me.......

Yesterday while talking to a neighbour, he told me that his wife had just crashed her car because a dog ran out in front of her. They claimed on the insurance but despite having a protected no claims discount they will lose it. As there was no other uninsured driver involved . I can't validate any accuracty of this statement as I don't know who they're insured with.

Anyway it made me check my own insurance for which I have a protected NCD add-on. There are two interesting statements:-

If you have comprehensive cover and you make a claim where the driver of the other car involved in the accident is found to be uninsured, you will not have to pay your excess or lose any part of your no claims discount (NCD) as long as:

● You are able to provide the make model and registration number of the other car involved;

● We can establish that you were not at fault in any way.

It will also help if you are able to provide the details of the other driver involved and details of any independent witnesses if possible.

When you first claim, you may have to pay your excess and your NCD may be affected but once we have established that you were not at fault in any way and the driver of the other car was uninsured your excess will be refunded and NCD restored

The following will not reduce your NCD:

1. any payment made under Section D (Windscreen and window damage).

2. any payment made under Section L (Breakdown option).

3. any payment for emergency treatment fees under Section C (Your legal liability to other

people).

4. claims where you are not at fault, provided we have got back all that we have paid from

those who are responsible

This last statement is interesting because it seems to me that if you're involved in an accident where the other party doesn't stop then you'll lose the NCD. Or what happens if you slide of the road and hit a tree - who owns the tree?

Many years back on the M25 a foreign lorry wandered over to my lane while I was overtaking, and scrapped all down the side of my car. It kept going and all though I reported it to the police there was no chance of finding out who was responsible. My insurance company paid but I didn't lose my NCD

No - it's a fault claim where your insurer has paid out and can't claim back off anyone elseUmmmm!

So if it's my fault I'd keep my no claims bonus?

Please excuse my ignorance about insurance but what's the point of protected NCD .

If I understand what your saying, any claim that's my fault, tree, other car, dog, whatever, then I'll lose my NCD.

If I have an accident where the other party is at fault I won't lose my NCD.

If I understand what your saying, any claim that's my fault, tree, other car, dog, whatever, then I'll lose my NCD.

If I have an accident where the other party is at fault I won't lose my NCD.

Do you loose it all in one go, or is there a progressive reduction against a number of claims. Doubtless your premium will rise but shouldn't part(s) of the NCD be reduced not taken away entirely.

Many companies operate a step back system - for example if you have 5 years NCD and make one claim you'd step back to 3 years NCD without NCD protection but retain 5 years NCD if it's protected - in both case the premium before NCD is likely to rise.Do you loose it all in one go, or is there a progressive reduction against a number of claims. Doubtless your premium will rise but shouldn't part(s) of the NCD be reduced not taken away entirely.

Decades ago motor underwriters considered a number of factors that enabled them reach a premium cost.Normally the lower the mileage the higher the premium. Insurance companies view it that the person is not a regular driver and is more of a risk than someone with high mileage who drives regularly.

Driver age. Seems young and old are now penalised Those who are 30-70 seem to do well.

Annual mileage. Mixed views . High mileage infers most driving done on motorways , safe. Low mileage. Lots of car park dings rear enders, roundabouts. But on the other hand lower mileage for some insurers means less time at risk so cheaper premium. I’d say the Jury is out and not all insurers follow the same underwriting protocol.

The cost of bodywork repair has risen astronomically particularly EV repairs which require very specialist equipment and staff safety procedures. Rest assured it will get worse. More Insurers will pull out of motor insurance. What next😢

TRENDING THREADS

-

-

-

Mandatory eye tests for drivers over 70 being proposed by HMG. Good or bad?

- Started by Dustydog

- Replies: 201

-

-

-

-