Background - when we changed our van our insurer couldn't insure our new van (no idea why) so we cancelled, and immediately started a new insurance policy with a different company.

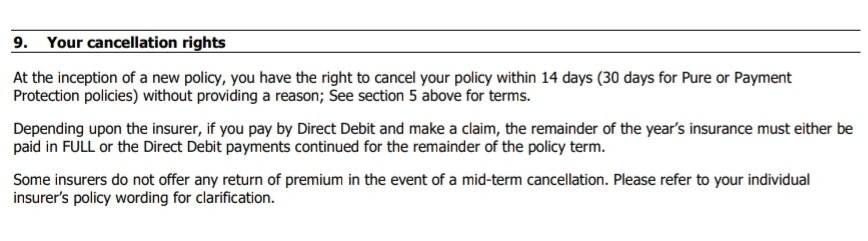

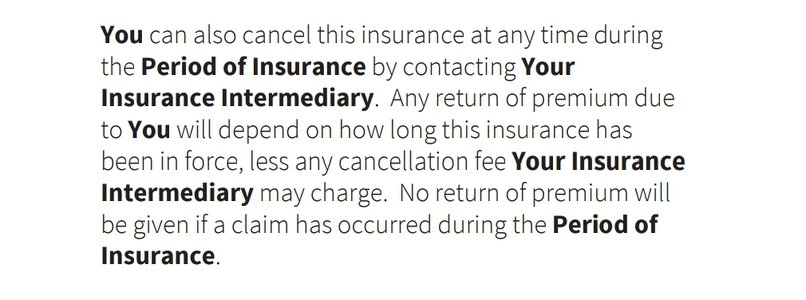

Now I get it, companies need to make money, and we were outside our 14 day cancellation on the old van. The insurance had been running for about 7 weeks by that point. The policy wording implies that we would be due for a pro rata refund. I imagined that would be our premium, minus insurance tax, minus legal cover, minus a fee, split over 12 months and refunded for the months not used... we're probably talking a round of drinks (north of Watford).

For the second time this year (first was mcycle policy) my cancellation fee has suspiciously been exactly what I would have been owed pro rata, effectively negating any refund.

Don't get me wrong, I probably need to get my magnifying glass out on the small print, but it feels a bit off.

Are we all being taken for a ride, or am I making a mountain out of a mole hill?

Now I get it, companies need to make money, and we were outside our 14 day cancellation on the old van. The insurance had been running for about 7 weeks by that point. The policy wording implies that we would be due for a pro rata refund. I imagined that would be our premium, minus insurance tax, minus legal cover, minus a fee, split over 12 months and refunded for the months not used... we're probably talking a round of drinks (north of Watford).

For the second time this year (first was mcycle policy) my cancellation fee has suspiciously been exactly what I would have been owed pro rata, effectively negating any refund.

Don't get me wrong, I probably need to get my magnifying glass out on the small print, but it feels a bit off.

Are we all being taken for a ride, or am I making a mountain out of a mole hill?