Warning: your towbar could invalidate your car insurance | Auto Express

Drivers could be in hot water if they don’t declare if a towbar is fitted when buying car insurance

This is a worrying trend if other insurers follow suit.

Plus 1 for always advising, but I’ve never purchased car insurance on line.Scary.

I have only been declaring a tow bar for about 20 years. Previously, I did not give it a thought. Since I have been declaring a tow bar. It has made zero difference to my premium.

There have been a number of topics on this forum advising members to declare. This topic will reinforce that message.

John

As reported, the story is rather worrying:I don' think that the insurance company will get away with it as the towbar had nothing to do with the accident. Secondly if the car came from the factory with the towbar already fitted, is it a modification? Same if bought new and the tow bar is fitted before delivery as it is an optional extra. I have always declared our to bar as most insurers do not regard the tow bar as a modification.

If you really think about it, having your vehicle done with a paint protection system is in effect modifying it. Adding washer water using a different type of fluid to the one used by the manufacturer is in effect modifying the vehicle. Fitting new tyres that are a different brand to the vehicle is modifying it. The list is endless!As reported, the story is rather worrying:

The Financial Ombudsman Service (FOS) decision found in favour of the insurance company. The Ombudsman cited the Consumer Insurance Disclosure and Representations Act on ‘misrepresentation’, which applies when information provided by the consumer to the insurer is incomplete or misleading, be it “carelessly, deliberately or recklessly”.

It would seem exceptionally easy for an insurance company to reject a claim if it chose to - baby seat fitted? seat covers? dog guard? With vague wording in the quotation form, any of these could constitute 'modifications'.

I just hope that there's more to the story, maybe something like a tow bar fitted to a vehicle that isn't homologated with a towing capacity or something like that.

Things such as described in your post don’t really constitute modifications. But on a Pajero I fitted non electcally controlled OEM shock absorbers and higher springs. No extra premium. On a Forester XT I swopped the coilover shocks and springs of the self levelling and installed non self levelling coil overs. Again no extra premium.As reported, the story is rather worrying:

The Financial Ombudsman Service (FOS) decision found in favour of the insurance company. The Ombudsman cited the Consumer Insurance Disclosure and Representations Act on ‘misrepresentation’, which applies when information provided by the consumer to the insurer is incomplete or misleading, be it “carelessly, deliberately or recklessly”.

It would seem exceptionally easy for an insurance company to reject a claim if it chose to - baby seat fitted? seat covers? dog guard? With vague wording in the quotation form, any of these could constitute 'modifications'.

I just hope that there's more to the story, maybe something like a tow bar fitted to a vehicle that isn't homologated with a towing capacity or something like that.

Travel insurers particularly don't like risk - I was quoted over £7,500 insurance premium for a two-week trip to the USA, so we didn't go!Things such as described in your post don’t really constitute modifications. But on a Pajero I fitted non electcally controlled OEM shock absorbers and higher springs. No extra premium. On a Forester XT I swopped the coilover shocks and springs of the self levelling and installed non self levelling coil overs. Again no extra premium.

On travel insurance it’s not uncommon for the insurers to look for non compliance. In my case I now have to declare a cancer which was found as a result of a totally seperately procedure. In reality it has absolutely no effect on my lifestyle and requires nothing at the moment other than period blood tests. So in reality I’m no different to before my procedure, but since I’m on a “pathway” it has to be declared. Nett result…. premium increase from my normal travel insurer. Insurers don’t like risk☹️

Good advice. If doing it Online normally then is a drop down list for added options like tow bar. As said is it a modification if the vehicle comes from the factory with a fitted towbar?To save the day and prevent situations like the one raised in the OP, it's worth the effort to just tell your insurers you have a tow bar fitted, and you intend to tow a caravan, then they know, and can't wriggle out of claim on a technicality.

Normally insurers do not charge extra for having a towbar, so for the cost of the time to write a letter or email to tell them if or when a towbar is fitted and to warn them you will be towing a caravan, it's worth the effort.

Many years ago I was rear ended while in France. I was doing 40mph so the person that hit me had to be doing at least 70. And this was entering a village!Having a fitted tow bar may cause more damage to the body shell if rear ended, so insurance repairs may be more costly as a result.....we always declare a tow bar is fitted, factory or aftermarket...

I don't know of any UK car that comes a standard with a towbar, it may be a factory fitted option you have to select when ordering. It is therefore a modification, all-be-it factory fitted one.Good advice. If doing it Online normally then is a drop down list for added options like tow bar. As said is it a modification if the vehicle comes from the factory with a fitted towbar?

On my last three cars your description is incorrect. The cars rear cross member a sophisticated box construction is removed. The tow bar attachment points fixed to the points used by the cars OEM cross member. So instead of a member designed to accept a rear or side impact with some degree of “crushability “ the towbar fixings put any load direct to the cars scantlings. These were Witter and Brink towbars.OK, let's clarify how most towbars are constructed these days rather than bleat on about the "good old days".

A towbar fitment to a modern car usually involves the replacement of the complete rear bar across the back of the car with one that is modified with the fixings etc for the tow bar assembly. That's not a "modification"? I beg to differ.

Can't be sure about your specific cars but the standard rear cross-member isn't generally designed to crush - the crush is done by the bumper cover and any foam underneath plus the structure forward of the cross-member.On my last three cars your description is incorrect. The cars rear cross member a sophisticated box construction is removed. The tow bar attachment points fixed to the points used by the cars OEM cross member. So instead of a member designed to accept a rear or side impact with some degree of “crushability “ the towbar fixings put any load direct to the cars scantlings. These were Witter and Brink towbars.

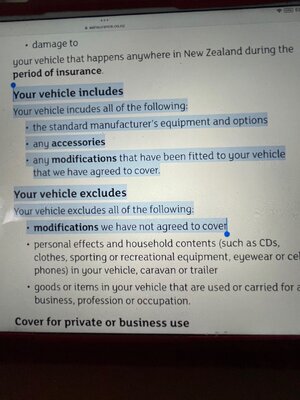

Checked on that before I wrote the post. Definitely not classed as an added modification if it came from the factory with the towbar already fitted. I had side steps added recently and that is not counted as a modifictaion.I don't know of any UK car that comes a standard with a towbar, it may be a factory fitted option you have to select when ordering. It is therefore a modification, all-be-it factory fitted one.

I recall on a past post way back BMW may be a candidate 🤔Checked on that before I wrote the post. Definitely not classed as an added modification if it came from the factory with the towbar already fitted. I had side steps added recently and that is not counted as a modifictaion.

I even declared the fitting of front sensors by a Kia dealer using the Kia sensor pack. Didn't change the policy premium. Fundamentally I don't trust insurers to not look for a get out if they can.I recall on a past post way back BMW may be a candidate 🤔

Equally I well recall 99% of people who bought a new car and requested a tow bar didn’t get what they thought .The Dealer called in a local towbar fitted who did the job. The Dealer then added his 35%.

The AA / Covea proposal form I recently filled in on line, as I said, was very specific about modifications even listing them .The recent FOS decision mentioned earlier will also have influenced most insurers in the information gathering at proposal time.

Listing them is covering both their and your position for the future.

Why play semantics and possibly prejudice your own claim?

Surely far better to err on the side of caution and disclose everything?